Newsletter - May 2024

This month we relaunch our Ultimate Tax Guide, updated for the 23/24 financial year, we revisit our Tax Q&A with accountant Lauren Thiel as well as exploring how to catch up on business admin in time for EOFY. We also share the best freelancing articles and podcasts we've collected this month!

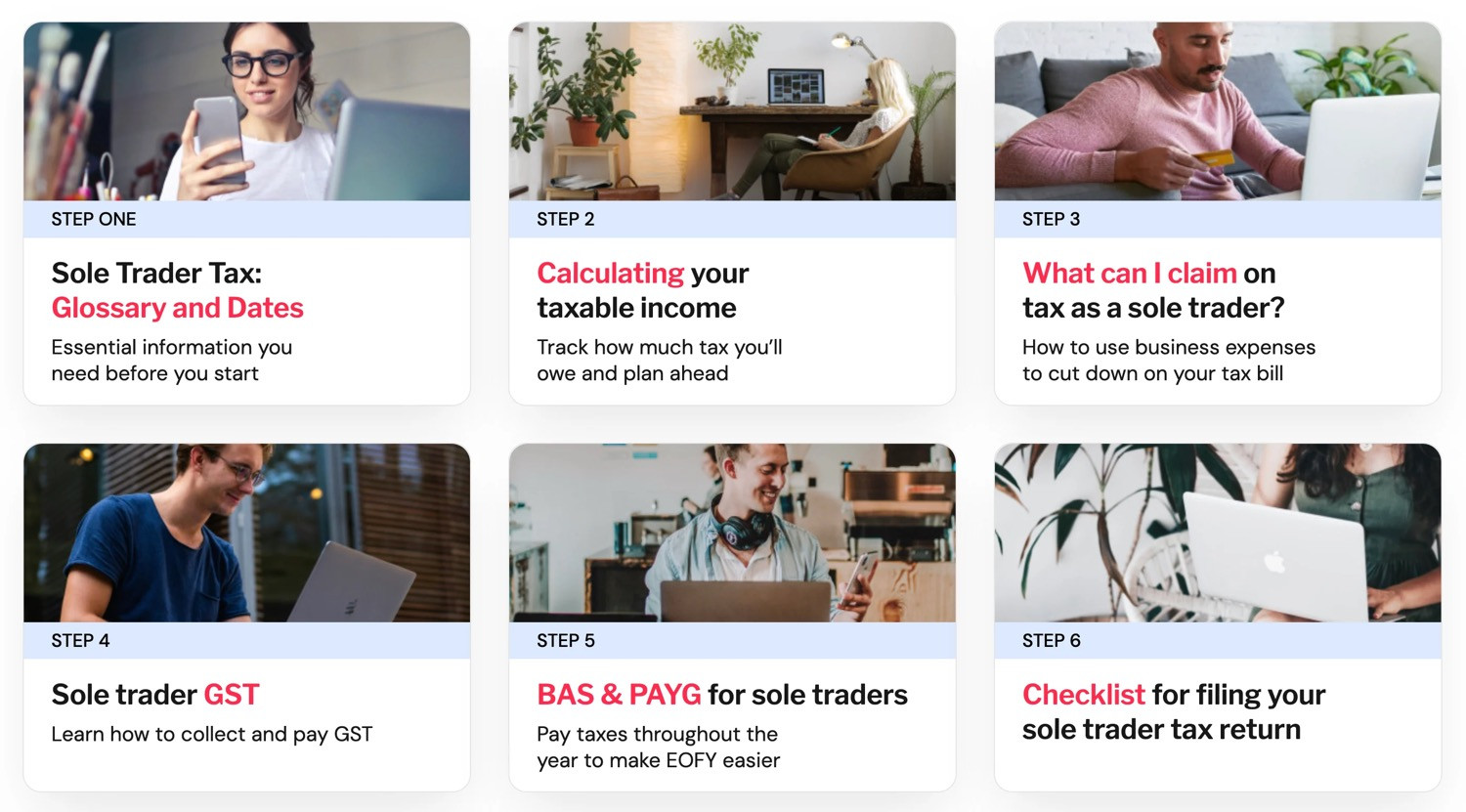

💡 Sole Trader Tax: The Ultimate Guide

We've revamped our Sole Trader Tax Guide just in time for EOFY 🎉

This online step-by-step guide has everything you need to know to lodge your tax return for the 2023-2024 financial year and prep for next year.

Or, if you just want to see the new changes for 2024, click here.

We also recommend refreshing yourself on what you can claim and work-from-home deductions, as the ATO will be focusing on these areas in particular.

We hope this helps take some of the stress out of tax time for you 😌

▶️ Tax Time Tune-Up: Expert Q+A with Lauren Thiel

Want to brush up on your tax knowledge and make sure you're up to date for the 2023-2024 financial year?

Then check out the recording of the chat we had with Lauren not long ago:

Lauren covered lots of different tax time topics including:

✅ Top sole trader tax mistakes

✅ Overlooked deductions you may be missing out on

✅ What the ATO is looking for this year and how to avoid these errors

✅ PAYG-I and how you can save for tax

✅ How to make the most of tax time this year and avoid a large tax bill

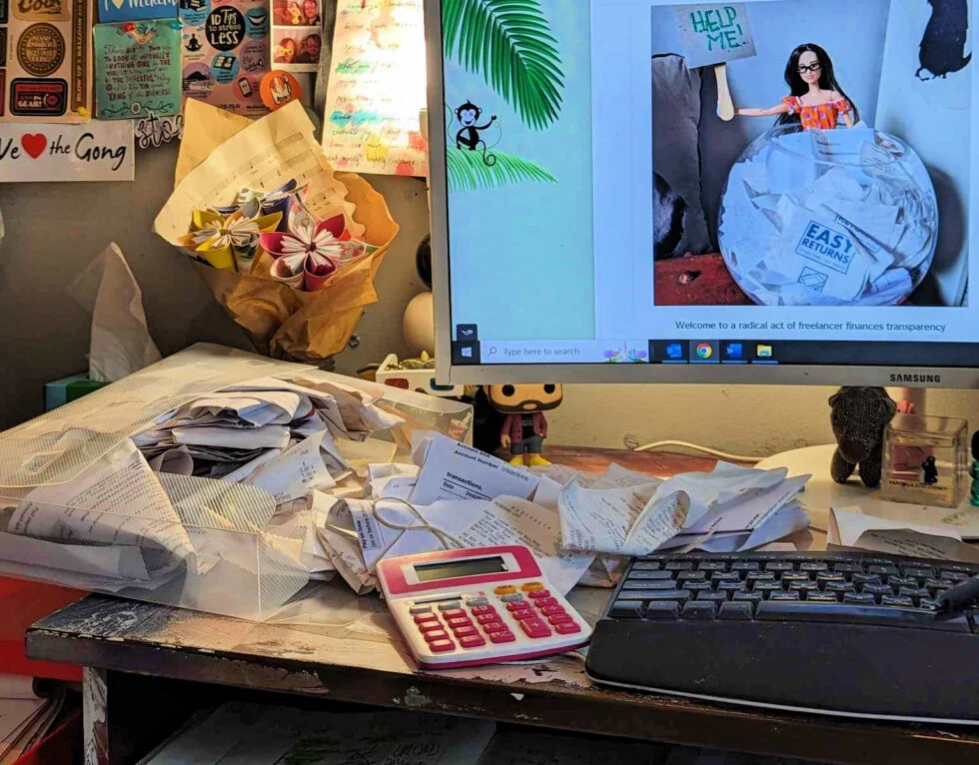

💡 Fallen behind on business admin? Here's how to catch up for EOFY

It's hard to keep records up to date when you have so many other things on your to-do list.

Here's how Rounded users can get up to speed and prepare expenses for their accountants.

Get suggestions for common expenses

If you’ve previously added a similar expense, Rounded will review it and make future suggestions on how to categorise it. You’ll get automated suggestions for vendor, GST status, category, and what percentage of it counts as a business expense.

Find out more about how to use auto-suggestions here.

Bek Lambert: Avoiding the quarterly accounting scramble

The biggest lesson I’ve learned is that keeping a closer eye on the financial side of my business would’ve helped me avoid all my problems. I’m definitely feeling more professional, empowered, and less stressed!

📣 Hear from the Rounded community

Honestly my tax is easy because I have good records. I have a nice accountant.

I don't find it difficult to keep records and I basically just make sure I’m booked in with Holly Shoebridge, my accountant. She's so busy these days—honestly, the hardest part is making sure that I'm booked in with her.

I just send my records, she logs into my Rounded account, does the thing, and then it's done. It's not very complicated.

- Martina Donkers, Freelance Grant and Evaluations Expert

🧠 More helpful resources

What the ATO is on the lookout for in your 2023-2024 tax return

Here’s a list of freelancer-friendly accountants if you need some extra advice

How to use evergreen marketing to avoid slow seasons as a freelancer with Prerna Malik

How to use Instagram to market your solo business in 2024 with Rah Gardiner

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

.jpg)