Checklist for filing your sole trader tax return

If you’ve followed this guide, you should now be able to gather all the information you need to file your annual tax return:

Your taxable income

Record of PAYG instalments made over the last financial year

Records of business expense claims from the last financial year

Records of GST collected on invoices over the last financial year

Records of GST paid on business expenses over the last financial year

Have you spoken with a tax professional?

Remember, it’s important to have a tax professional review your return before you submit it to the ATO.

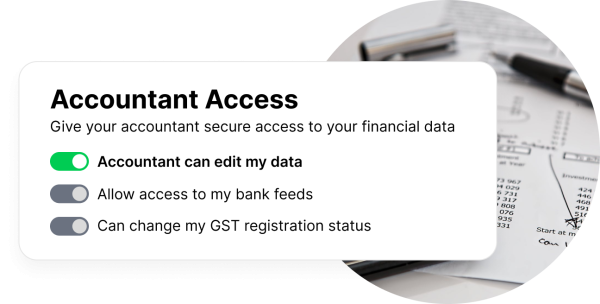

Rounded users can give their tax specialist secure access to their dashboard so they can look everything over.

Checked everything off this list? Then it’s time to file!

If you’d like to see the changes since last year check out our New Updates for 2024 guide!

Need to revisit a step?

-

Step One

Step OneSole Trader Tax: Glossary and Dates

Essential information you need before you start -

Step 2

Step 2Calculating your taxable income

Track how much tax you’ll owe and plan ahead -

Step 3

Step 3What can I claim on tax as a sole trader?

How to use business expenses to cut down on your tax bill -

Step 4

Step 4Sole trader GST

Learn how to collect and pay GST -

Step 5

Step 5BAS & PAYG for sole traders

Pay taxes throughout the year to make EOFY easier -

Step 6

Step 6Checklist for filing your sole trader tax return

I love that I can quickly find the $ info I need for my BAS and give my accountant access to Rounded for the yearly tax return. I also love that because Rounded is an Australian company they know what GST is all about. Highly recommended!

As a sole trader, tax used to be something I dreaded. I hated doing my business activity statement and keeping track of my PAYG instalments. But with Rounded, I barely have to do anything! It takes about 30 seconds to pop the numbers into my BAS, and all I have to do for my income tax return is share access to my account with my accountant.

Doing my business taxes used to be the hardest part of being a freelancer. Now, it literally takes me minutes to submit my return every year. I love the tax calculator – it makes it super easy to see where I stand throughout the year so I can make sure I have enough stashed away.