BAS & PAYG for sole traders

Key takeaways:

Learn what PAYG instalments are and why they matter

Learn how to file your quarterly Business Activity Statements

Figure out what to do if you missed a PAYG instalment

Prepare to make PAYG instalments for the coming year

Unlike employees, who only have to worry about tax once a year, sole traders are required to make payments throughout the year.

The good news: you won’t have to worry about a huge tax payment in your annual tax return.

The bad news: you’ll have to stay on top of payments and quarterly Business Activity Statements, which can be a big hassle if you don’t have the right knowledge or tools.

Luckily, we’re here to answer all your questions and give you a helping hand.

What is BAS?

A Business Activity Statement (BAS) is a form you submit to the ATO each quarter if you are registered for GST, summarising:

The total earnings for your business over the quarter

The GST you charged to clients over the quarter

The GST you paid on business expenses over the quarter

Your quarterly PAYG instalment

If you have employees, your PAYG-w instalment

The ATO will automatically notify you when your BAS is due each quarter, once you have registered your business for GST and received an ABN. They’ll provide confirmation once it’s been received.

Think of BAS like an umbrella term, that includes PAYG and everything else listed in here.

How do I estimate BAS?

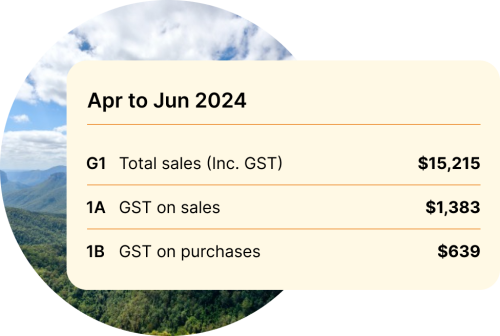

The ATO will send you a form in your MyGov account inbox that asks for three pieces of information:

The total earnings for your business over the quarter (line G1)

The GST charged to clients over the quarter (line 1A)

The GST you paid on business expenses over the quarter (line 1B

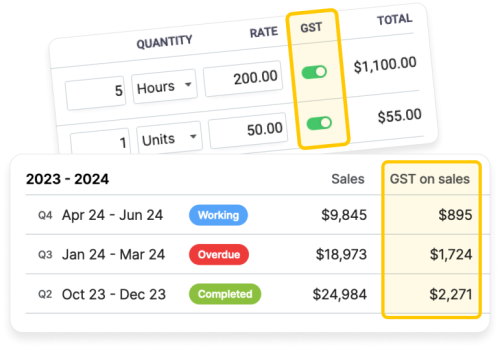

Pro-Tip: If you’re a Rounded user, just check the “Activity Statement” section of your reports. We automatically track GST and calculate these 3 figures for you, so all you need to do is copy them into the ATO form.

What is PAYG?

Pay-As-You-Go (PAYG) instalments are the ATO’s method of collecting quarterly income tax payments, so you don’t have to make a huge tax payment in your annual tax return.

You’ll pay PAYG instalments quarterly, and if you’re registered for GST, your PAYG instalments will be included within your BAS.

The ATO will provide an estimate for how much you owe and will either send you an instalment notice or include the PAYG instalment amount within your quarterly BAS.

PAYG withholdings are only relevant if you have employees. If you do pay employees, you are required to withhold a certain amount of tax from their pay, which you will then send to the ATO.

Who has to submit PAYG instalments?

If you expect to earn more than $4,000 in business income over the course of a tax year, and you had business income tax payable from the year prior, you’ll most likely be required to make PAYG instalments.

Alternatively, you can register to make voluntary PAYG-I instalments.

How will I know how much to pay each quarter?

The ATO starts sending PAYG activity statements to eligible people following the end of the financial year (June 30th), or after the most recent income tax return lodgement that returns an amount of income tax payable above $1,000.

The tax office will use your most recent tax filing information to estimate your first payment, which can be a bit tricky if you’ve recently transitioned out of full-time work into freelancing.

Fortunately, you can vary your PAYG instalments to pay a different amount based on your own estimates. Try using this free PAYG instalment calculator to get a better estimate.

How do I pay my PAYG installments?

Visit your MyGov portal and link your MyGov and ATO accounts.

Wait to receive a PAYG Instalment Notice or Instalment Activity Statement in your MyGov inbox.

With these forms, fill out the basic information regarding your income, expenses, and investments.

You will then have the option to make the payment from a bank account or use a credit card for a fee.

What if I’ve missed a PAYG installment?

It’s not uncommon to miss a PAYG instalment, especially if it’s your first time filing taxes as a sole trader.

The best thing to do is contact your professional tax agent, or reach out directly to the ATO to let them know that you cannot make a payment or have missed a payment. They’ll help you organise a payment plan to help make up the missing amount.

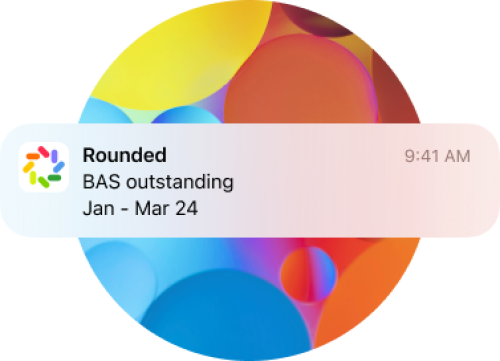

Bear in mind, the ATO may apply penalty interest on missed payments. With Rounded, you’ll be able to track how much money you need to set aside, and you’ll get automatic reminders when BAS filings are due.

Rounded makes BAS simple

Automatically add GST from invoices and expenses to Activity Statements

Get all the numbers you need for your BAS in an instant

Be reminded when it’s time to submit BAS or if your form is overdue

-

Step One

Step OneSole Trader Tax: Glossary and Dates

Essential information you need before you start -

Step 2

Step 2Calculating your taxable income

Track how much tax you’ll owe and plan ahead -

Step 3

Step 3What can I claim on tax as a sole trader?

How to use business expenses to cut down on your tax bill -

Step 4

Step 4Sole trader GST

Learn how to collect and pay GST -

Step 5

Step 5BAS & PAYG for sole traders

Pay taxes throughout the year to make EOFY easier -

Step 6

Step 6Checklist for filing your sole trader tax return