What can I claim on tax as a sole trader?

Key takeaways:

Learn what sole traders can and cannot claim

What you need to know about receipts

Learn how to use Rounded for easy expense tracking

Running a freelance business costs money – you have to cover everything from your internet connection to petrol to office supplies.

Luckily, you can cut down on your tax bill by claiming these business expenses!

Learn how you can reduce your taxable income as much as possible by claiming every expense you’re entitled to.

What counts as a business expense?

Use these four rules as a general guide when assessing your expenses.

The expense must directly relate to operating your business, not personal use.

If the expense is for both business and personal use, you can only claim the portion of the cost that is used for your business.

You must have records to prove it. Often this means a receipt, though there are exceptions to this rule for vehicle and home office running expenses, as well as uniform expenses. Learn more here.

Always speak with a certified tax accountant before submitting your expense claims to the ATO.

Expense cheat sheet

Although we always suggest speaking with a certified tax accountant and reviewing the ATO site, here’s a general overview of what you can and can’t claim.

Download it here so you can review later!

Work-from-home deductions

If you run your business from home, you may be able to claim:

Occupancy expenses (e.g. mortgage interest or rent, council rates, land taxes, house insurance premiums)

Running expenses (e.g. electricity, phone, furniture and furnishing repairs, cleaning)

The cost of vehicle trips between your home and other locations (if the travel is for business purposes)

You can claim both occupancy expenses and running expenses if you have a certain area set aside as a place of business, such as a dedicated home office.

However, it’s always best to check with a registered tax accountant if you plan on claiming these deductions, as they don’t apply to all home-based businesses. For example, if your work falls under personal services income rules, you may not be able to claim occupancy expenses.

There are two things you should remember:

You can only claim the business portion of your expenses

If you’re entitled to GST input tax credits (see Sole trader GST for more details), you must claim the deduction in your income tax return at the GST exclusive amount.

For more information about deductions for home-based businesses, see the ATO guide here.

How do I calculate running expenses for a home-based business?

There are two methods you can use:

Actual cost method – If you have records of expenses incurred while working from home, you can claim the actual amount.

Fixed rate method – From July 1, 2024, you can claim 70 cents for each hour you work from home. This applies to electricity, gas, stationery, computer consumables (e.g. printer ink), internet, and phone expenses.

For the fixed rate method, you’ll need to have a record of how many hours you worked from home and the expenses you incurred. You’ll also need to have records for the expenses the fixed rate doesn’t cover, along with the work-related portion of those expenses.

Pro-Tip: Using Rounded’s built-in time tracker makes it easy to keep an accurate record of how many hours you worked. Having your timesheets and expense reports in one place means that everything will be nice and organised come tax time!

Occupation-specific deductions

Some deductions can only be claimed by people in a certain industry.

For example, beauty professionals may be able to claim the cost of makeup and beauty products, while a freelance writer or trade business couldn’t.

The ATO has provided general guidelines for the following industries:

To find out more about occupation-specific deductions that may apply to you, we recommend consulting a registered tax accountant.

How do I claim business expenses?

Business expenses can be claimed as tax deductions on your annual tax return, filed after June 30.

If you’re set up as a sole trader, you can claim deductions in the ‘Business and professional items’ section of your individual tax return. You can either do this yourself by lodging online with myTax, or by using an accountant or tax agent.

If you’re set up as a company, you’ll need to claim deductions in your company tax return.

What about depreciating assets?

If you purchased any assets up to the value of $20,000 in the 2024-2025 tax year, and your business has a turnover of less than $10 million, you may be eligible to claim this immediately as a tax deduction by utilising the instant asset write-off.

The $20,000 threshold will apply on a per (eligible) asset basis, allowing sole traders to instantly write off multiple (eligible) assets.

To check if you can claim this deduction, it’s best to speak to an accountant. They’ll need to know details like:

The date you bought the asset

The amount paid

GST withheld

The % used for business

They’ll also need a purchase invoice or receipt.

Pro-Tip: If you’re using Rounded, you can label any assets that may qualify for instant write-off under “Equipment” within your P&L Statement.

How do I track business expenses?

The ATO requires sole traders to keep records for many expenses they claim at tax time. You are allowed to submit photos or electronic copies of your receipts, which you can upload to Rounded for safekeeping.

The easier way to track expenses for your solo business

Rounded Connects seamlessly with hundreds of banks

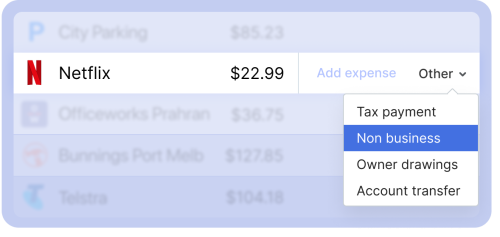

Auto-track recurring expenses and easily mark with expenses with one click

Get AI Suggestions for common expenses and reconcile in an instant

-

Step One

Step OneSole Trader Tax: Glossary and Dates

Essential information you need before you start -

Step 2

Step 2Calculating your taxable income

Track how much tax you’ll owe and plan ahead -

Step 3

Step 3What can I claim on tax as a sole trader?

How to use business expenses to cut down on your tax bill -

Step 4

Step 4Sole trader GST

Learn how to collect and pay GST -

Step 5

Step 5BAS & PAYG for sole traders

Pay taxes throughout the year to make EOFY easier -

Step 6

Step 6Checklist for filing your sole trader tax return