Apply for an ABN: A guide for sole traders

As a sole trader, before you can issue your first invoice, you’ll need to apply for an Australian Business Number (ABN). This guide walks you through exactly how to do just that.

Article contents

− +

Getting an (ABN) is a vital first step in the career of any sole trader. This number will be attached to your business name, and will help both the Australian government and your clients and vendors identify your business.

If you’re wondering how to get an ABN, this article is for you. Follow the steps here, and you’ll be one step closer to launching your freelance career.

Who needs an ABN?

If you’re just starting out as a freelancer, you might be wondering, “Do I need an ABN?” The answer is simple:

If you are operating your own business in Australia and expect an annual turnover of at least $75,000 AUD, you are required to create an ABN. Even if you are earning less than this, it’s still a good idea to get an ABN if you are a sole trader, in case you pass that threshold at some point in the future.

There is no cost to create an ABN and it only takes a few minutes to register, so it’s a win-win situation for sole traders.

You’ll need an ABN when registering for GST, and it’s important to include the number on any invoice you send. If you don’t list your ABN on your invoices, you could be subject to a high tax rate of 47% on payments you receive under the PAYG system.

How do you know if you’re operating a business in Australia? Generally, if you are providing goods and/or services in exchange for payment with Australian businesses, you should apply for an ABN. This is true even if your income from these businesses is quite low, or if you are employed elsewhere simultaneously. For more detail, review this ABN entitlement checklist from the Australian Business Register.

What does an ABN do for sole traders?

The ABN is more than just a number you need to include on your freelancer invoices. You will also use your 11-digit ABN to:

Claim GST credits to get reimbursed for GST you spend on business expenses

Purchase an Australian domain name (with .com.au on the end) for your freelancer website

Avoid paying PAYG tax on payments you receive

Claim energy grants credits, if you’re eligible

How to apply for an ABN

You can apply for an ABN online at the Australian Business Registry and the process usually takes around 15 minutes if you have all the necessary information.

There are services that can do all the hard work for you. For example, Easy Companies will get you an ABN in 2 minutes for less than $50 AUD. Not bad!

If you’d rather apply on your own, here’s how to do it:

Before you start: Choose your sole trader business name

Before you begin your ABN application, decide whether you’ll be doing business under your own name (ex. “Jane Smith”) or a business name (ex. “Jane Smith Web Design”).

Check out our full guide on choosing a business name if you’re not sure.

If you plan to do business under your own legal name, you can skip ahead to step 1 below and start your sole trader ABN application now.

If you plan to create a business name, then you’ll need to first check the business name availability using this tool. If your business name is already taken, look for slight variations or try something else.

Note: There are fees involved to register your business name: $39 AUD for one year and $92 for three years. You’ll also need to renew your business annually, at these same rates.

Once you’ve determined the business name you want is available, you can register your business name at the same time as you apply for an ABN.

1. Gather the information you’ll need to apply

If you’re applying as a sole trader, you’ll need documents to prove your identity (a passport, ID card, driver’s license, or birth certificate), your Tax File Number (TFN), and details of the services you intend to provide. You can also review the Australian Business Register’s website for a more in-depth list of what you’ll need.

2. Visit the ABN registration website

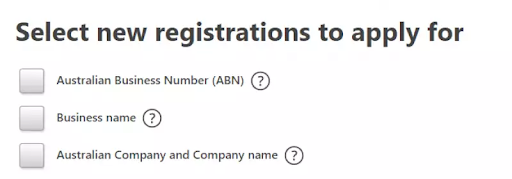

Use the link above to begin the registration process. At the start, you can choose to register for an ABN on its own, or you can also register your business name if you’re taking that route.

At the bottom of the screen, you’ll also see options to register for GST and PAYG.

If you aren’t sure whether you should register for these options, it’s best to speak with an accountant.

3. Create an account

Next, you’ll need to create an account. Keep track of your login credentials, as you may need to revisit this portal when filing taxes or reapplying for an ABN later on.

4. Select your business structure

On the next screen, you’ll be prompted to select your business structure. For sole traders, select “Individual.” (If you’re curious, you can learn more about the difference between sole traders vs. company designations here.)

5. Enter your business details and confirm your ABN application

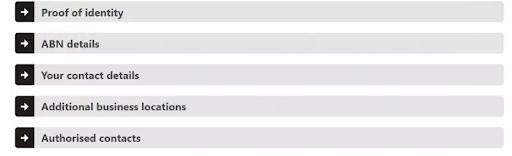

The rest is simple: Follow the prompts to enter your details, and once you’ve reviewed it all, confirm your application. These are the sections you’ll need to fill in:

Frequently Asked Questions about ABNs

Now that you’ve got your ABN sorted, what do you do with it? Here is some guidance for using your ABN properly going forward:

How long does it take to get an ABN after I apply?

If you’ve provided all of the necessary information, you will most likely receive notification of your ABN instantly after submitting your application.

If this didn’t happen for you, contact the Australian Business Register directly to inquire about the status of your application.

Where do I put my ABN on invoices and documents?

As we mentioned above, you’ll need to put your ABN on every invoice you send, as well as any official documents (like your letterhead). This is an important step to avoid higher taxation each quarter.

The precise placement of your ABN on your invoices is up to you—just make sure it’s clearly visible. If you’re a Rounded user, your ABN will automatically appear on the top right of your invoices, under your name and details.

What’s the difference between an ABN and a TFN?

A Tax File Number (TFN) and an Australian Business Number (ABN) are separate, unique numbers. Every person in Australia needs a TFN to complete an annual tax return, but you only need an ABN if you are running a business.

As a sole trader, your ABN and your TFN will be linked. This is because as a sole trader your business is the same legal entity as yourself (unlike a registered company). Any money you earn through your ABN by issuing invoices to your clients forms your taxable income, which you’ll declare in your annual tax return.

Related: Everything you need to know about tax for sole traders

How do I look up my ABN?

If you ever lose track of your ABN, don’t worry—you can easily find it using the ABN search function on the Australian business register website. Just enter your name or business name into the search bar, and you should see yourself listed with your ABN number.

Does an ABN expire?

ABNs do not have an expiry date—once it’s yours, it’s yours for good unless it’s cancelled. The Australian Tax Office routinely reviews ABNs and will cancel any that have been inactive.

You shouldn’t have to worry about this as long as you are continually conducting business, but if you close down your business or stop providing services at any time, you should cancel your own ABN, which you can do here.

If your ABN is cancelled in error, you can contact the ATO or reapply for an ABN under the same business structure.

How do I update my ABN details?

If you move house or change any of your other details, you need to update your ABN information through this website.

I’ve got an ABN. Now what?

Once you’ve got your ABN, keep the number handy, as you’ll need it when sending invoices and filing taxes.

Rounded makes invoicing clients easy—you’re ABN is automatically attached in the right place on every invoice you send.

I’ve got an ABN. Now what?

Once you’ve got your ABN, keep the number handy, as you’ll need it when sending invoices and filing taxes.

Rounded makes invoicing clients easy—you’re ABN is automatically attached in the right place on every invoice you send.

Ready to take control of your freelance business?

Applying for an ABN is just the first step toward running a successful business as a sole trader. We have lots more resources to help guide you as you get your freelance operation off the ground.

Check out our resource hub for all of our best guides and tools, or sign up for our newsletter to get advice, tips, and news about freelancing in Australia delivered right to your inbox. (You can sign up in the menu bar to the right 👉). You can also get tips and insights from other freelancers in our Advice library.

It may seem like a small step, but getting an ABN is a lot like making your freelance business official. So congratulations from the Rounded team, and welcome to the freelance family!

Cover Photo by Christina @ wocintechchat.com on Unsplash

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

-p-1600.jpeg)